Rate Cuts Are Coming, But They Are Not What You Thought

Lower interest rates sound like relief.But they’re actually a warning sign. Since June 2024, the Bank of Canada has slashed rates by 225 basis points, bringing the

You work hard for your family every day. Let us help you secure your financial future—with a free Financial Blueprint designed specifically to help Canadian families achieve real wealth, faster.

Here’s the reality:

The financial system wasn’t built to help Canadian families thrive.

It’s designed to keep you paying longer, saving less, and dependent on banks that profit from your debt.

That’s why we exist.

We help Canadian families take back control, gain real financial clarity, and finally start building lasting wealth—without confusion or pressure.

Let's remove the stress from your family’s monthly budget and give you real financial breathing room. We’ll align your savings and investments with your family’s priorities—so you can build lasting wealth and achieve your dreams, even faster.

Debt shouldn’t be a life sentence. We’ll show you how to eliminate it up to 50% faster — without working more hours or giving up your lifestyle — using practical strategies designed specifically for busy Canadian families.

Whether it's buying your family’s first home with tools like the FHSA and RRSP or funding your children's education with optimized RESPs, we help you clearly understand government grants, matching programs, and tax-free growth opportunities—making your family’s biggest goals achievable.

Canadian families shouldn't overpay in taxes. We’ll help your family find opportunities to save more, significantly reduce your tax bill, and strategically build wealth through income splitting, RRSP/TFSA optimization, and more.

Your family deserves a secure, worry-free retirement. We'll clearly explain your retirement options (CPP, OAS, pensions, RRSPs, and more) and show you how to confidently use them as the cornerstone of your family's stable financial future.

Your family works hard—but where’s it all leading? We’ll help you identify what truly matters, whether that's early retirement, family vacations, or future milestones. This is where your dreams stop feeling distant and start becoming real—with clear timelines, actionable strategies, and consistent support.

We believe Canadian families deserve more than just getting by—they deserve true financial freedom, genuine peace of mind, and a financial plan that actually works.

We’re here to challenge a system that’s kept families overworked, financially stressed, and uncertain about their future. Through honest guidance and proven strategies, we help you reclaim control of your family’s finances, your time, and your future—so you can build a life that feels secure, prosperous, and fulfilling.

– Michael Knapp, Financial Representative & Founder of the Wealth For Canadians Movement

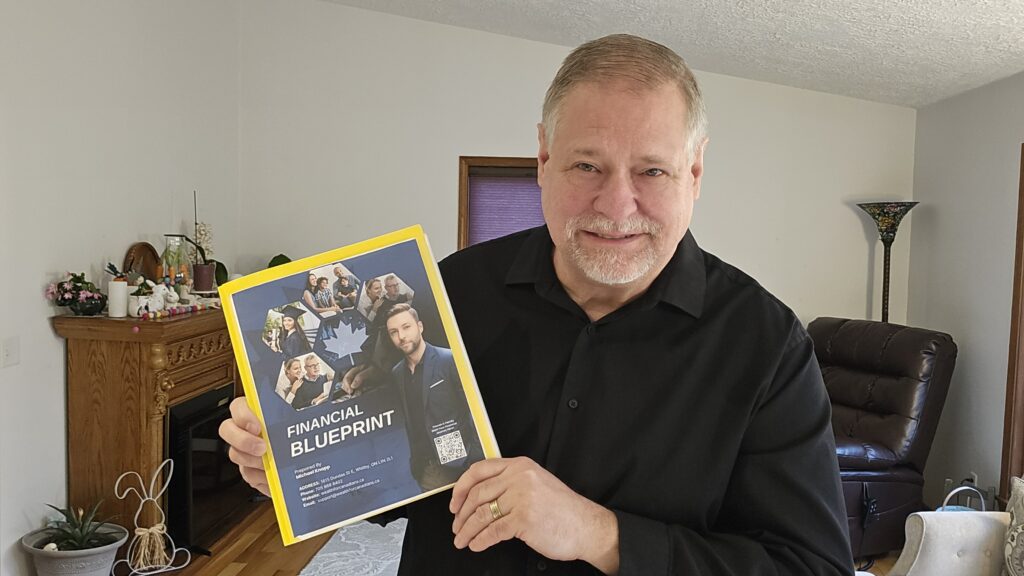

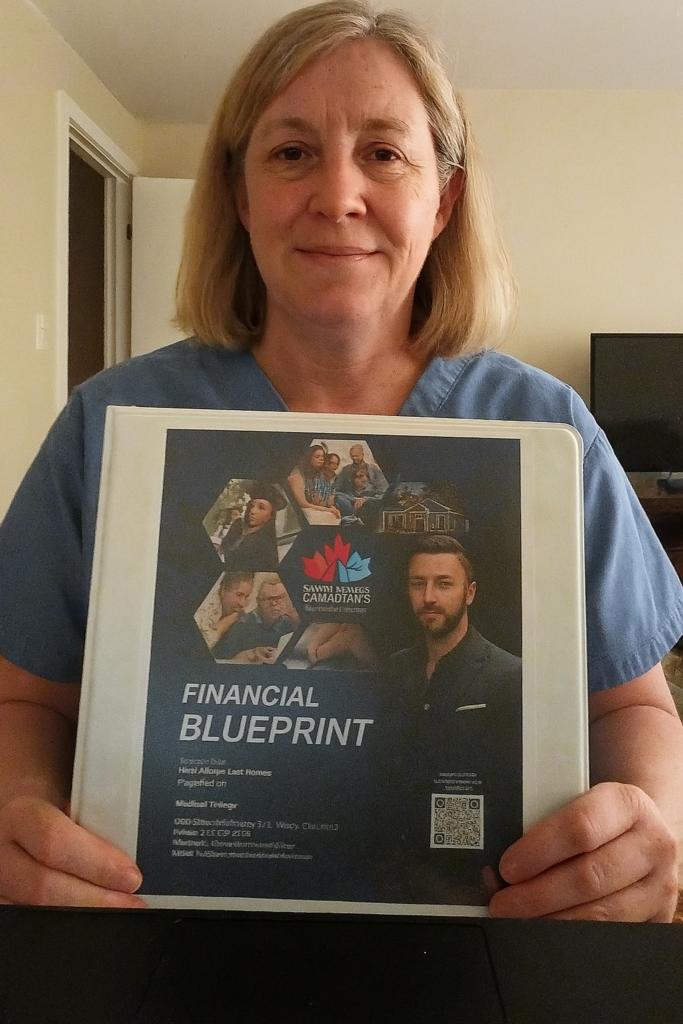

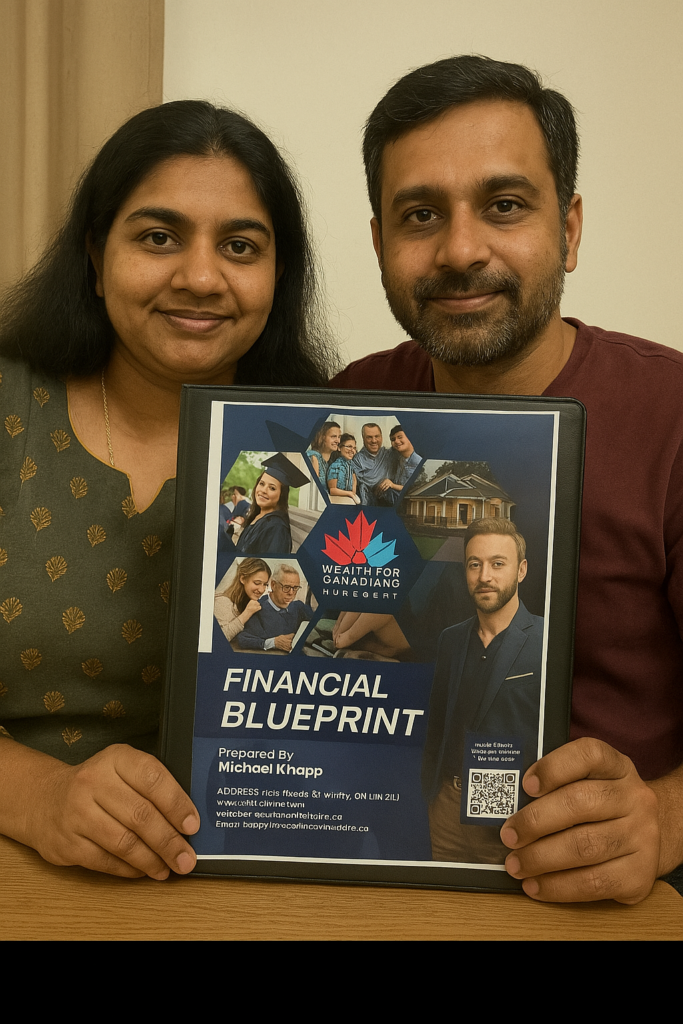

These are real families. Real jobs. Real goals.

Whether working at hospitals, schools, factories, or small businesses—we’ve helped everyday Canadians take control of their finances and secure their futures.

Learn how to maximize your family’s income, grow tax-free savings, and confidently use tools like RESPs, RRSPs, and FHSAs to create a secure financial future.

Reduce debt faster, enhance your family's monthly cash flow, and stop overpaying in taxes—all without compromising your lifestyle.

Ensure your family and future are secure, with a clear, easy-to-follow plan for building and passing on lasting wealth.

We’ll begin with an easy, comfortable conversation about your family’s financial picture, goals, and any challenges that you’re facing right now. Tell us what’s most important—whether it’s cutting down debt, saving for education, or securing your retirement.

Using everything you’ve shared, we’ll create a personalized financial blueprint tailored specifically to your family’s income, debt situation, savings goals, and dreams. Our aim? Reduce stress, build wealth faster, and give your family real financial clarity.

Finally, we’ll guide you through implementing your new financial plan. You’ll get ongoing support and regular check-ins to ensure your plan stays aligned with your family’s changing needs. Need extra guidance along the way? We’re always just a quick call or message away.

I didn’t think much about retirement before, I was just focused on surviving. But after working with Michael, I finally understand my HOOPP pension and how to make it work for me. I actually have a plan now and I’m on track to retire 7 years earlier and debt-free. It was the good news I’ve needed.

We honestly didn’t know where to start with our RESPs, RRSPs, pensions… it all felt very overwhelming for us. Michael took much of his time with us. He helped us plan for our sons’ future and our own retirement without us having to give up everything. We’re so thankful him.”

I was working overtime, stressed about money, and still falling behind. Michael broke everything down in a way that actually made sense. No fluff. Just a clear strategy to get out of debt faster, protect my income, and finally feel in control.”

Not at all — we work with all types of healthcare professionals and Canadians. That said, we specialize in helping those with HOOPP and OMERS pensions, and we know how to make those systems work to your full advantage.

Yes, it’s completely free — and always will be. There’s no catch, no pressure, and no sales pitch. You’ll get a full breakdown of your finances with a step-by-step plan you can actually use. And we’ll meet with you annually or semi-annually to keep it updated as your life and goals evolve.

That’s totally fine — many of the people we help already have an advisor. What makes this different is that we don’t just focus on products or investments. We build a full financial strategy around your pension, income, debt, taxes, and long-term goals — and we meet with you regularly to keep everything on track.

Not at all — and it’s time well spent. Our first call takes about 45 to 60 minutes so we can fully understand your income, pension, goals, and current situation. We’ll then walk you through your personalized plan in one follow-up session. After that, we meet once or twice a year to update your strategy — or sooner if something changes in your life, the pension system, or the economy. We keep an eye on the big picture so you don’t have to.

That’s up to you — the choice is entirely yours. We’ll show you exactly what you have, how it’s working, and whether there are better ways to help you reach your goals faster. If it makes sense to make a change, we’ll explain it clearly — but you’re always in the driver’s seat.

Yes — we help families set up RESPs for education and FHSAs or RRSPs for first-time home purchases, while also showing you how to use these tools tax-efficiently. With the right strategy and stronger returns, your contributions can go further — giving your kids more opportunities with less financial strain later on.

Lower interest rates sound like relief.But they’re actually a warning sign. Since June 2024, the Bank of Canada has slashed rates by 225 basis points, bringing the

In its latest interest rate decision, the central bank held its key policy rate at 2.75%, pausing after seven consecutive cuts. At first glance, this

The Bank of Canada just slashed its benchmark interest rate to 2.75%. This decision comes hot on the heels of escalating trade tensions, particularly with